Measurable treatment plan objectives are essential for demonstrating medical necessity in insurance documentation. Insurers expect objectives to follow the SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—and to link diagnosis-related symptoms directly to interventions using observable indicators such as frequency, duration, or intensity.

When objectives are vague or subjective, payers cannot evaluate progress or continued need for care, which often leads to audits or denials. This guide explains how to write clear, insurance-compliant treatment plan objectives that reflect real clinical work—without reducing therapy to a checklist.

What Makes an Objective “Measurable” in Insurance Terms?

Measurable treatment plan objectives are concrete, time-bound, and actionable clinical milestones—written using SMART criteria—that translate symptoms and functional impairments into specific, quantifiable targets (e.g., frequency, duration, intensity, or standardized scale scores). They replace vague therapeutic intentions with observable outcomes that allow clinicians and payers to evaluate whether interventions are effective, such as “reduce panic attacks from 6 to 3 per week within 4 weeks.

From an insurance perspective, measurable objectives are not optional language refinements—they are the foundation of audit-ready documentation.

Specifically, a measurable objective must make it unmistakably clear:

1. What clinical problem is being treated

(Which symptom, behavior, or functional impairment linked to the diagnosis)

2. How change is being tracked

(What observable data shows improvement, stagnation, or deterioration)

3. When progress will be reviewed

(A defined timeframe that justifies continued or adjusted care)

If any one of these elements is missing, the objective becomes clinically meaningful but administratively weak—and vulnerable during audits. This is why payers consistently deny claims where goals are aspirational but not operationalized.

Key Components of a Measurable Objective (SMART Criteria)

| SMART Component | What It Means in Insurance Documentation | Audit-Ready Example |

|---|---|---|

| Specific | Clearly identifies the exact symptom, behavior, or functional impairment being targeted—not a general emotional state. | Identify 3 anxiety triggers associated with panic episodes. |

| Measurable | Uses quantifiable indicators such as frequency, duration, intensity, or standardized assessment scores. | Reduce panic attacks to fewer than 2 per week. |

| Achievable | Reflects realistic progress based on diagnosis, symptom severity, and current level of functioning. | Decrease panic attacks from 5 to 3 per week within early treatment phase. |

| Relevant | Directly linked to a DSM-5 diagnosis and supports symptom reduction or functional improvement. | Objective targets panic symptoms related to Panic Disorder diagnosis. |

| Time-Bound | Includes a defined review period that supports medical necessity and continued care. | Achieve target within 6–8 weeks. |

Linking Measurable Objectives to Medical Necessity

Medical necessity is not implied by therapist intent or client distress—it must be explicitly documented. For objectives to meet medical necessity documentation standards, they must clearly:

1. Target symptoms of a diagnosed condition: Every objective should map back to a DSM-5 diagnosis and its associated symptoms.

2. Demonstrate functional impairment: Symptoms alone are insufficient unless they interfere with daily functioning.

3. Show how treatment reduces risk, symptoms, or deterioration: The objective must justify why ongoing therapy is required now.

If an objective does not support one of these points, insurers may determine that treatment is no longer medically necessary—even if therapy remains clinically appropriate.

Examples of Measurable Treatment Plan Objectives by Clinical Category

Depression

Vague Objective (Audit-Weak): Improve mood

Measurable Objective (Behavioral Activation)

Client will increase engagement in pleasurable or meaningful activities from 1 to 4 times per week within 6 weeks to reduce depressive symptoms.

Score-Based Objective (Symptom Reduction)

Client will reduce PHQ-9 score from 15 (moderate depression) to 10 or below within 8 weeks.

Anxiety & Panic

Vague Objective (Audit-Weak): Manage anxiety symptoms

Measurable Objective (Symptom Frequency)

Client will reduce panic attacks from 5 per week to 2 or fewer per week within 8 weeks, as tracked via anxiety journal and session report.

Skill-Based Objective (CBT-Oriented)

Client will demonstrate use of two cognitive restructuring techniques to challenge anxiety-related thoughts, reported weekly in session.

Behavioral & Substance Use Disorders

Reduction Objective (Substance Use)

Client will reduce alcohol consumption from 10 drinks per week to 3 or fewer drinks per week by [date], verified via self-report and urine screening.

Engagement Objective (Recovery Support)

Client will attend two recovery support group meetings per week for 12 consecutive weeks to support sobriety maintenance.

Anger & Emotional Regulation

Observable Behavioral Objective

Client will reduce verbal outbursts from 6 per week to 2 or fewer per week for four consecutive weeks.

Skill Demonstration Objective

Client will demonstrate two one-minute deep-breathing or grounding exercises in session when reporting heightened emotional arousal.

Social & Interpersonal Functioning

Social Anxiety Objective

Client will initiate conversation with at least two new individuals per week for four consecutive weeks to reduce social avoidance.

Communication Objective (Interpersonal Skills)

Client will use “I feel” statements to communicate emotions in 3 out of 5 conflict role-play scenarios, verified during session.

Why These Examples Work for Insurance

Across all categories, these objectives succeed because they:

- Replace vague emotional goals with observable change

- Use quantifiable metrics (frequency, scores, attendance)

- Show direct links to diagnosis and functioning

- Include timelines that justify ongoing care

- Support audit ready documentation

This is the standard insurers expect when evaluating measurable treatment plan objectives—and the level of clarity that protects your practice during reviews.

Tips for Writing Insurance Compliant Objectives

Writing measurable treatment plan objectives is only one part of insurance compliance. Payers evaluate the entire documentation pattern to determine whether care is medically necessary, effective, and appropriately managed over time. The following practices significantly reduce audit risk and claim denials.

1. Focus on Functioning

Insurance reviewers prioritize functioning, not emotional experience alone. Always document how symptoms interfere with daily life, work, relationships, or self-care.

Example (insurance-ready):

Client’s impaired concentration has resulted in a 50% decrease in work productivity.

Measurable treatment plan objectives should directly target these impairments to support medical necessity documentation.

2. Use Standardized Measures

Incorporate objective tools such as PHQ-9, GAD-7, BDI, or ORS to establish baselines and track measurable therapy outcomes. Standardized scores reduce subjectivity and strengthen documentation for insurance audits, especially when progress is gradual.

3. Tie Goals to Diagnosis

Each objective must clearly reduce a symptom of a DSM-5 diagnosis. Goals that are not diagnosis-linked are often flagged as non-essential during utilization reviews.

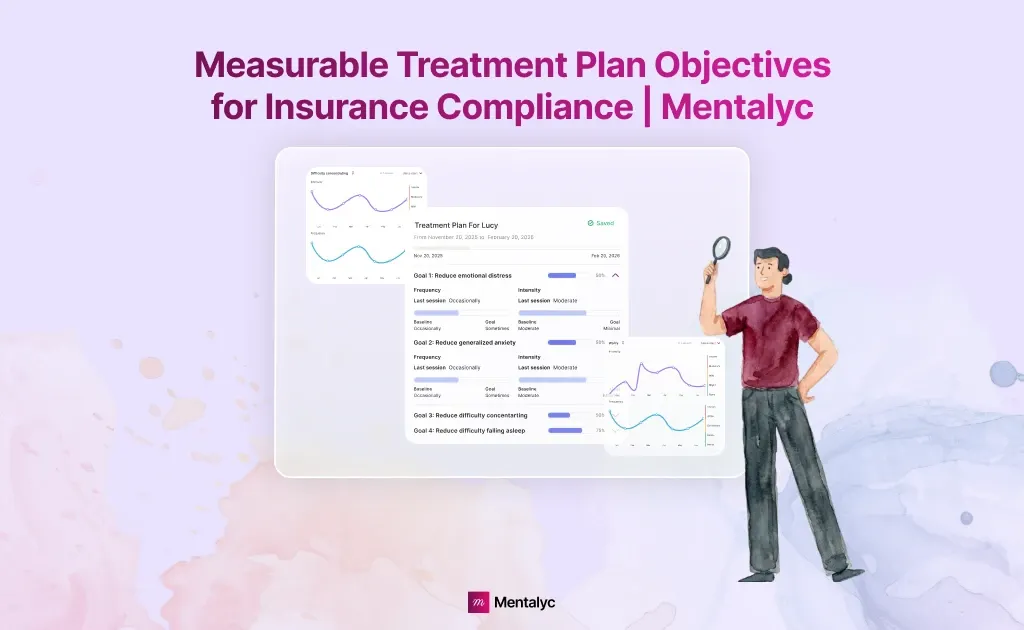

Mentalyc’s AI Treatment Planner helps maintain this alignment by generating SMART objectives directly from documented symptoms and diagnoses.

4. Avoid Vague Terms

Avoid unmeasurable phrases such as:

- “Client will feel better”

- “Client will increase self-esteem”

- “Client will heal inner child”

Instead, use frequency, duration, intensity, or observable behaviors—critical for insurance compliant therapy documentation.

Regularly Review and Update Treatment Plans

Update Regularly

Most payers expect treatment plans to be reviewed and updated every 30–90 days or whenever goals change. Static plans are a common audit risk.

Show Progress or Need for Care

Documentation must clearly show either:

- Measurable progress toward objectives, or

- Ongoing medical necessity to prevent deterioration or relapse

Lack of improvement still requires clear clinical rationale.

Use EHR Tools That Support Measurable Goals

Effective EHR systems should support measurable objectives, progress tracking, and diagnostic alignment.

Mentalyc integrates with existing EHR workflows and keeps treatment plans, progress notes, and outcomes connected—maintaining the Golden Thread and reducing audit stress without extra documentation work.

How Mentalyc Supports Measurable, Insurance-Ready Objectives

| Aspect of Treatment Planning | Before Mentalyc | With Mentalyc |

|---|---|---|

| Goal Creation | Goals written manually from scratch | SMART goals suggested instantly from session notes |

| Objective Quality | Often generic or inconsistently measurable | Diagnosis-linked, measurable treatment plan objectives |

| Progress Visibility | No clear or centralized view of progress | Measurable therapy outcomes auto-tracked over time |

| Time Investment | 30–45 minutes per treatment plan | Treatment plans generated in minutes |

| Plan Maintenance | Difficult to keep plans updated as clients change | Plans evolve automatically as new sessions are added |

| Insurance Readiness | High audit stress and documentation uncertainty | Documentation stays insurance-ready and audit-defensible |

Consistently creating measurable treatment plan objectives that meet payer expectations requires more than good intentions. It requires documentation that is structured, diagnosis-driven, and continuously updated. Mentalyc is designed to support this exact need by turning routine session documentation into clear, insurance-ready objectives without adding administrative burden.

SMART Objectives Built From Real Session Content

Mentalyc’s AI Treatment Planner generates SMART, measurable objectives directly from your intake and progress notes. Because objectives are derived from what was actually discussed in session, they reflect real symptoms, real impairments, and real clinical priorities. This ensures objectives are written in objective clinical language, include quantifiable targets (such as frequency, intensity, or duration), and are framed within a clear review timeframe—making them suitable for insurance review from the start.

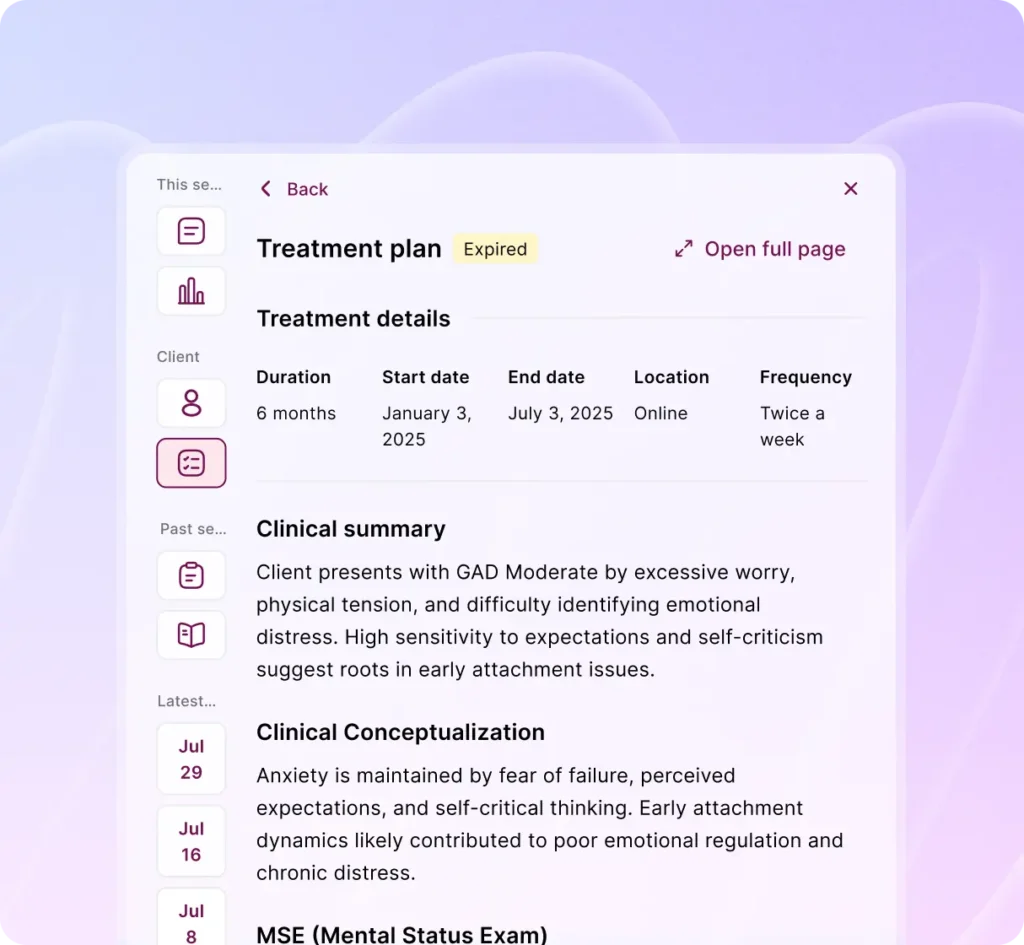

Diagnosis-Driven Alignment With Medical Necessity

Insurance compliance depends on showing that every goal addresses a diagnosed condition. Mentalyc keeps objectives tightly aligned with documented DSM-5 diagnoses by anchoring each goal to symptoms already captured in your notes. This reduces the risk of treatment plans being flagged as vague or unrelated to medical necessity and helps ensure that objectives clearly justify why ongoing care is required at each stage of treatment.

Progress Tracking That Makes Outcomes Visible

Writing measurable objectives is only half the work. Demonstrating progress over time is what payers ultimately evaluate. Mentalyc automatically tracks progress toward each objective as new session notes are added, without requiring additional forms or questionnaires.

Symptom trends and goal progress become visible across sessions, making it easier to demonstrate measurable therapy outcomes or explain why continued treatment is needed to prevent deterioration.

Maintaining the Golden Thread Across Documentation

A common audit issue is fragmented documentation, where treatment plans, progress notes, and outcomes do not clearly connect. Mentalyc preserves the Golden Thread by keeping intake findings, diagnoses, objectives, and progress notes linked in one continuous clinical narrative. This continuity helps reviewers quickly understand how treatment decisions are made and how each session supports the overall plan of care.

Clinician Control With Compliance Built In

Mentalyc is designed to support and not replace your clinical judgment. Clinicians retain full control over treatment plans and can edit objectives or refine language at any time. At the same time, the platform remains fully HIPAA, PHIPA, and SOC 2 Type II compliant, with no recordings stored and no data used for model training. This balance allows clinicians to document in their own voice while staying aligned with insurance requirements.

Conclusion

Choosing measurable treatment plan objectives is not just a documentation preference. It is a clinical and compliance necessity. Insurance reviewers rely on clear, time-bound, and observable objectives to determine medical necessity, assess progress, and justify continued care. When objectives are tied to diagnosis, focused on functional impairment, and tracked over time, documentation becomes defensible, audit-ready, and clinically coherent rather than reactive or rushed.

Tools like Mentalyc support this process by turning real session work into SMART, diagnosis-driven objectives that stay aligned as clients change. By keeping treatment plans, progress notes, and outcomes connected, clinicians can focus on care delivery—while remaining confident that their documentation meets insurance expectations without added administrative burden.

Frequently Asked Questions (FAQs): Measurable Treatment Plan Objectives

1. What do insurance companies look for in measurable treatment plan objectives?

Insurers look for objectives that are specific, measurable, time-bound, and directly tied to a DSM-5 diagnosis. Objectives must demonstrate functional impairment and show how treatment is reducing symptoms or preventing deterioration.

2. How often should treatment plans be reviewed for insurance compliance?

Most payers expect treatment plans to be reviewed every 30–90 days, or sooner if goals are met, symptoms worsen, or the treatment approach changes. Regular updates help maintain medical necessity documentation.

3. Are standardized measures required for insurance compliance?

Standardized measures such as PHQ-9, GAD-7, BDI, or ORS are not always mandatory, but they significantly strengthen documentation by providing objective data and supporting measurable therapy outcomes.

4. Can therapy still be medically necessary if progress is slow?

Yes. Insurance does not require constant improvement, but documentation must clearly explain why continued treatment is necessary—such as preventing relapse, managing risk, or addressing external stressors that limit progress.

5. Why are vague goals often denied during audits?

Goals like “feel better” or “increase self-esteem” are subjective and cannot be measured. Insurers require observable indicators such as frequency, duration, intensity, or standardized scores to verify progress.

6. How does Mentalyc help with insurance-ready treatment planning?

Mentalyc generates SMART, diagnosis-linked objectives directly from session notes, automatically tracks progress over time, and preserves alignment between treatment plans and progress notes—reducing audit risk.

7. Can clinicians edit or customize objectives created by Mentalyc?

Yes. Clinicians maintain full control over all objectives, including language, targets, and timeframes, ensuring that documentation reflects professional judgment while remaining insurance-compliant.

Why other mental health professionals love Mentalyc

“It immediately changed my quality of life, personally and professionally.”

Owner/Independently Licensed Marriage & Family Therapist (LMFT)

“If I were recommending this software to a colleague, I would tell them that it is the best thing that they could do for their practice.”

Licensed Professional Counselor

“Do yourself a favor, make your life easier. I found Mentalyc to be one of the best tools that I’ve ever used.”

Licensed Marriage and Family Therapist

“For anyone hesitant: this is a lifesaver. It will change your life, and you have more time to be present with your patients.”

Licensed Clinical Social Worker